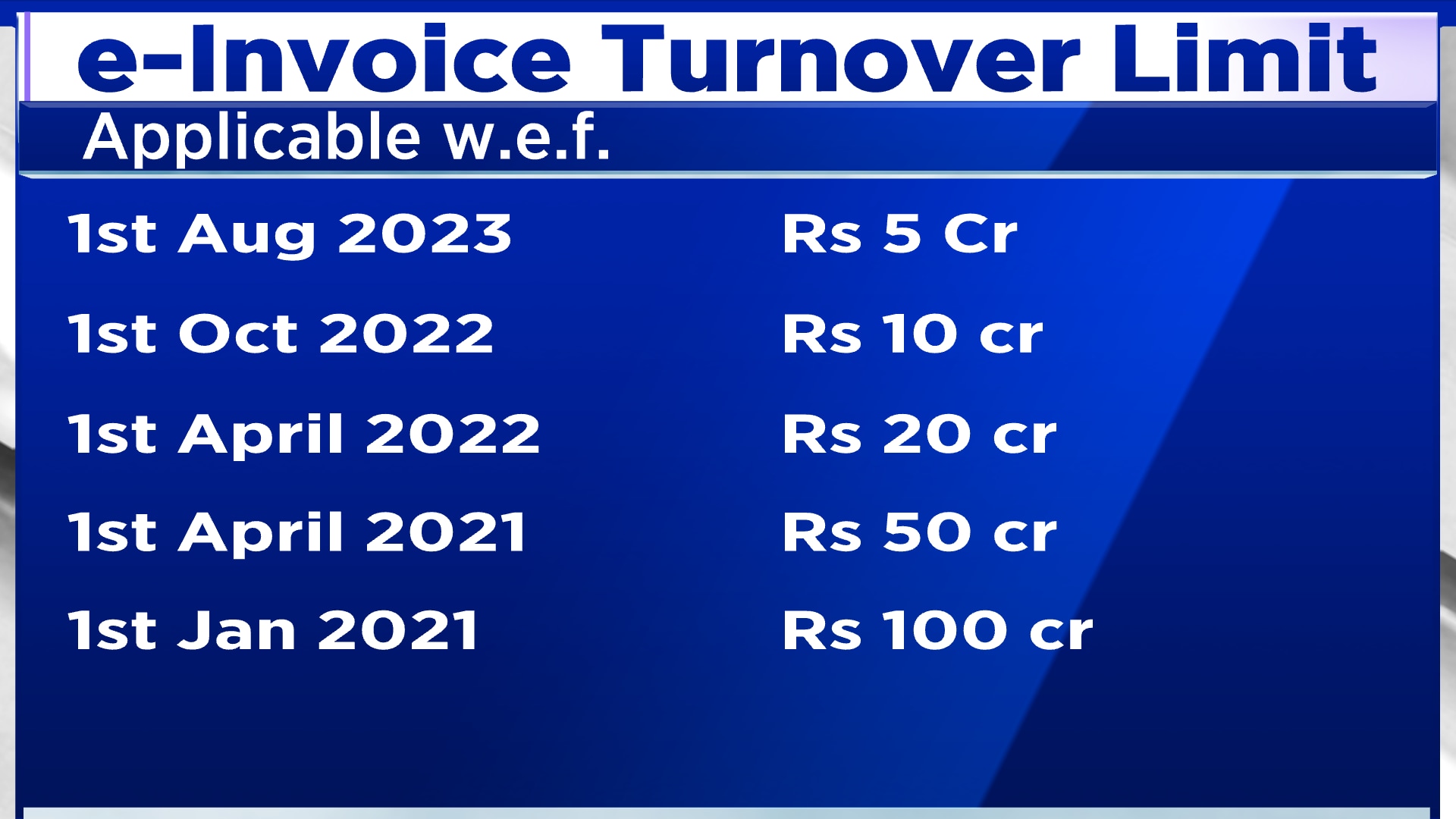

E Invoice Turnover Limit 2025-25. Conduct regular reconciliations between physical stock and. Corporate tax rates remain 30%, with a reduced rate of 25% for companies with a turnover below ₹400 crore.

Corporate tax rates remain 30%, with a reduced rate of 25% for companies with a turnover below ₹400 crore. Those who have tax liabilities of inr 10,000 or more in a financial year, have to make advance tax payment.

New Turnover Limit for e invoicing from 1St Aug 2023 New GST Invoice, Conduct regular reconciliations between physical stock and.

Mandatory einvoice from August 1 for GST taxpayers with turnover, It’s important that businesses know the applicable rate, tds section and exempt limit for each nature of payment.

E INVOICE NEW TURNOVER LIMIT E INVOICE NEW GST UPDATE YouTube, Those who have tax liabilities of inr 10,000 or more in a financial year, have to make advance tax payment.

E Invoice Turnover Limit 202425 Ardith Gwendolin, 95% of receipts must be through online modes.

New Turnover Limit for e invoicing from 1st Aug 2023 GST E INVOICE, Details the sections, nature of payment, threshold limit, and the corresponding tds rates.

E invoicing limit Reduce E Invoicing for 5 Crore turnover under GST, The finance act, 2023 has enhanced the turnover threshold limit from inr 2 crores to inr 3 crores for opting for the presumptive taxation scheme under section 44ad if the.

e invoice portal new advisory for taxpayers turnover more than 5cr, In case you not qualify conditions of 95% of receipts through online modes (other than cash), then limit will be 50 lakh

Einvoice GST Limit Guide) InstaFiling, In case you not qualify conditions of 95% of receipts through online modes (other than cash), then limit will be 50 lakh

Einvoicing for GST is not mandatory for firms with a turnover greater, It’s important that businesses know the applicable rate, tds section and exempt limit for each nature of payment.